Market Snapshot

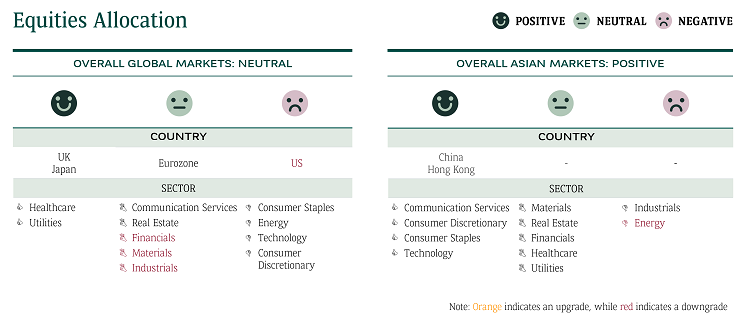

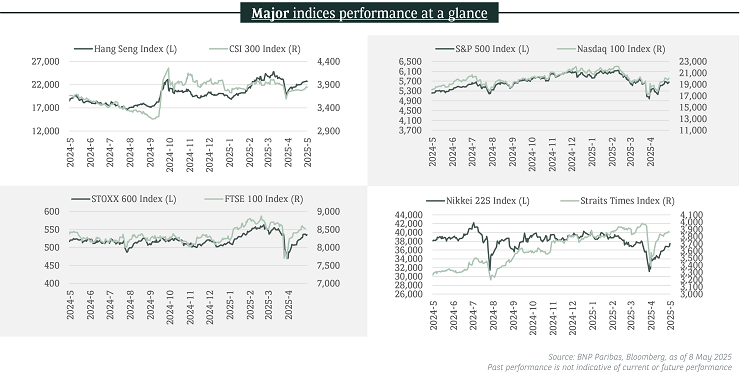

Global equities have rebounded since early April 2025’s tariff induced selloff on optimism surrounding US trade de-escalation and solid first quarter earnings. We note, however, that many companies have turned more cautious on their forward guidance, while tariff rates also remain higher than they were in 2024.

We see the recent rebound as a great opportunity for investors to geographically diversify equity holdings. Ample opportunities are present in both Europe and HK/China, supported by fiscal spending packages and undemanding valuations. European Industrials are likely to be beneficiaries of the region’s increased capex spending, while we favour leading internet and electric vehicle companies within HK/China.

In the US, we maintain a selective stance, with preference for quality and healthy balance sheets as well as relatively less direct exposure to tariff headwinds. Sectors such as healthcare and utilities fit the bill nicely.

HK / China: Sailing in choppy waters

Dramatic escalation and de-escalation of US-China trade tensions have caught many investors unguarded.

What happened?

Market sentiment has been strapped to a roller-coaster ride by perplexing US trade policies since late March 2025, while individual company’s fundamentals and AI-enthusiasm took the backseat. On 12 May 2025, US and China agreed to dial back tariffs to 30% and 10%, respectively, for 90 days. The world’s two largest economies will also formulate a mechanism to continue discussions about economic and trade relations. Sky-high tariffs represent a de facto trade embargo, causing the number of ships departing from China for the US West Coast to drop sharply in late April 2025, according to data released by logistics firm Flexport.

Separately, the People’s Bank of China (PBoC) unanimously strengthened monetary tools on 7 May 2025 to boost loan growth and reduce financing costs. Key policies include: (i) Lowering reserve requirement ratio (RRR) by 50 basis points (bps) to release RMB1 trillion long-term liquidity; (ii) Cutting policy rate by 10 bps; (iii) Cutting the lending rate of the House Provident Fund by 25bps; (iv) Beefing up relending quota by RMB1.1 trillion, including RMB500 billion for service consumption and elderly care, RMB300 billion for science and technology upgrade and RMB300 billion for agriculture and small businesses. Other government bodies and provincial governments are also expected to roll out a vast array of fiscal stimulus soon to offset US business shortfalls.

Our thoughts

We observed two constructive developments in the Hong Kong stock market, even before the de-escalation of US-China trade tensions on 12 May 2025. (1) Hot money flows into Hong Kong, which very often coincide with cyclical bull markets. On 5 and 6 May 2025, The Hong Kong Monetary Authority absorbed nearly HKD130 billion worth of US dollar sell orders. The Aggregate Balance surged to HKD174.1 billion, the highest level since July 2022. (2) Widening market breadth will build a solid foundation for long-term market growth. The ratio of Hang Seng Index constituents which outperformed the index since 20 January 2025 (i.e. the “DeepSeek moment”) increased from 27% as of 12 March 2025 to 37% as of 8 May 2025.

How to play the game?

Areas on our radar: Beneficiaries of potential consumption-oriented fiscal stimulus in China, while also keeping a close-eye on de-escalation or (unwanted) re-escalation of US-China trade tensions.

Investment implications: Investors are likely to refocus on individual company’s improving fundamentals. We favor leading China internet and electric vehicle companies, as well as high dividend yield stocks backed by resilient free cash flow.

Notable Developments in Selected Sectors

- Manufacturers & exporters: De-escalation of US-China trade tensions are strong tailwinds for industrial companies in China, which had seen dramatic decrease in new orders due to uncertainties over tariff rates.

- Financials: PBoC launched a new monetary easing package on 7 May 2025. Falling policy rate is expected to suppress net interest margin of banks, whilst the abundant financing facilities are generally positive for non-bank financials.

- US-listed Chinese companies: The US’ Trump administration has insinuated to delist the American depositary shares (ADS) of Chinese companies. In the unlikely but unfortunate scenario of broad-based US delisting, we think companies with dual-primary listing in Hong Kong and lower share of total daily stock turnover in the US ADS than HK-listed shares shall see lower liquidity risks.

US: Monitoring for sustained trade de-escalation

What happened?

Since our last publication highlighting a neutral stance on US equities, our house adopted a more cautious stance to asset allocation and downgraded the equity market further in early April 2025 after President Trump announced one of the biggest tariff increases in the history of the US on Liberation Day, which were significantly larger than market expectations.

While we think the 90-day trade truce between US and China announced on 12th May 2025 is encouraging in de-escalating trade tensions substantially and lowering the risks of a US recession, we note tariff rates remain higher than they were in 2024, which should still pressure profit margins. We maintain a neutral stance on global equities ahead of more clarity on ongoing trade negotiations between the US and rest of the world.

Our thoughts

We maintain a prudent stance on US equities taken in early April 2025 after the dizzying slew of trade-policy-related announcements since Liberation Day, which elevated market uncertainties and had negative implications for consumption, confidence and ultimately growth prospects of the US economy ahead should ongoing trade negotiations disappoint.

The backward-looking Q1 2025 corporate reporting season has been better than expected. While it has seen solid earnings per share beats, forward guidance had turned more cautious, reflecting the recent deterioration in macro-economic outlook as the number of profit warnings increased. Firms also started to share their mitigation strategies for navigating tariff headwinds and provided initial estimates quantifying the potential impact of tariffs on fundamental metrics such as sales, margins and cost of goods.

With the latest updates made to corporate guidance, consensus forecasts for MSCI US index’s earnings growth had started to turn negative, suggesting that trade policy uncertainties were starting to weigh on demand and investment outlook. As of 6 May 2025, MSCI US index’s FY25E and FY26E earnings per share (EPS) growth were moderated to about 9.8% and 14.4%, down from a prior 11.9% and 14.6% respectively a month ago.

The trajectory of earnings revisions in the coming months will be important for indications on whether the recent bounce in equities can be sustained, which should be influenced to a large extent by how trade policy negotiations pan out. With MSCI US index valuations of 19.4x forward price/earnings still looking fairly elevated (above its 10-year historical average of 18.1x), we maintain a selective stance, reiterating our earlier call for diversification. Stocks wise, we prefer quality firms with healthy balance sheets, pricing power and less direct exposure to tariff headwinds.

How to play the game?

Areas on our radar: Trade negotiations, earnings, corporate guidance and economic growth trajectory.

Investment implications: Maintain a more prudent asset allocation approach focusing on diversification, preferring quality firms with healthy balance sheets, relative pricing power and less direct exposure to tariffs.

Notable Developments in Selected Sectors

- Financials: Large US banks spearheaded recent performance on the back of strong quarterly results, driven by a windfall in equity trading income amid market volatility. However, cautious outlook statements highlighted the tension between robust operational performances and tariff-related worries on the economy. While investment banking activity is expected to remain muted in the near term, deregulation may act as an industry support later this year.

- Information Technology: Market sentiment had turned positive since the recent tariff-induced correction, driven by hyperscalers’ solid results and resounding guidance coupled with de-escalating trade tensions. Reassuring infrastructure spending by key AI enablers aligns positively with market sentiment. We maintain a constructive medium-term outlook as fundamental growth drivers within the theme remain robust.

- Utilities: The sector emerged as a defensive darling amid global trade tensions, offering refuge for investors under its isolation against sales volume shocks and tariff risks. It remains a solid add to portfolios as uncertainties persist, with structural trends such as reshoring and AI continuing to underpin energy demand and sector fundamentals.

Europe/UK: Diversification merits remain

What happened?

President Trump’s tariff announcements may have added to market volatility, but European equities have remained outperformers over the course of 2025, despite mixed macro data and political tensions.

Germany’s federal election has helped change the investment landscape for the region, with the coalition government, led by new Chancellor Friedrich Merz, significantly enhancing regional growth possibilities. The government has proposed a EUR500bn special fund for infrastructure spending spread over ten years, as well as finally more financial leeway for the German states.

In addition, there was a new proposal that “necessary defence spending” above 1% of GDP should be exempt from debt brake restrictions, with no upper limit. This opens the way for substantial spending. Combined with the EU’s ReArm Europe plan, this could have positive trickle-down effects for regional stocks. We expect more spending clarity to come from the NATO convention on 24-25 June 2025.

Our thoughts

The fiscal spending story could remain a key driver for the market, though investors have found additional catalysts. For example, stocks aligned with structural themes (e.g., renewable energy and AI) and investment opportunities surrounding a potential end to the Ukraine-Russia conflict have also benefited. Moreover, European stocks still trade at reasonable valuation levels (the Stoxx 600’s Price to Earnings (P/E) of 14.6x, as of 7 May 2025).

Separately, the results season has been modestly supportive, with Banks and Healthcare registering the strongest earnings surprises. Stocks particularly exposed to tariffs and global trade policy uncertainty, though, have led the downgrades.

With economic data mixed, the UK government has taken a pro-growth tone. However, the Labour Chancellor may renege on her promises to raise tax, which would be a blow to confidence. Still, a lot of negativity is already reflected in market valuation. The UK still offers value, trading on 12.4x forward P/E for the FTSE 100 as of 7 May 2025, with the market’s defensive merits remaining

How to play the game?

Areas on our radar: Defence spending clarity, Trade negotiations, earnings, corporate guidance.

Investment implications: Europe’s defence spending story is a key long-term growth opportunity; the UK meanwhile continues to provide defensive diversification.

Notable Developments in Selected Sectors

- Financials: Banks remain the best Stoxx 600 performers in 2025, supported by strong Q1 2025 results. Broader confidence remains healthy, with the banking sector offering substantial shareholder returns on the back of strong earnings. A potential continuation in regional sector M&A would also be positive, with the sector having seen the most M&A activity since 2020.

- Materials: The sector lags the market on a year-to-date basis, but Germany’s EUR500bn infrastructure fund and a potential ceasefire in the Ukraine are expected to be supportive for the sector. We upgraded European Chemicals from Negative to Neutral in recent months after sizeable underperformance over the last 2-3 years.

- Industrials: Supported by increased fiscal spending in Germany, the sector is expected to be a beneficiary of increased capex spending in key structural growth areas, including defence, electrification, industrial automation and renewables. The sector would also benefit if we see a resolution to the Ukraine-Russia conflict and a country rebuild.