A majority of investors have been focusing on the “Magnificent Seven” stocks in the US with stellar performance last year (+76%).

This year, investors are also looking at “Granolas Eleven” in Europe and “Seven Samurai” in Japan, with those baskets of large cap stocks bringing their respective equity markets to all-time highs. In general, global large caps have outperformed global small caps by 17% (as of 2 April 2024) since the beginning of 2023.

The small/mid cap universe is increasingly a less efficient market given declining analyst coverage, making them fertile for stock picking approach. The return dispersion for small/mid caps is more than double that of large caps. In fact, global small caps have massively outperformed global large caps over the long term by 238% since 2000 (as of 2 April 2024). Most investors are underweight this subsector of the equity market.

As Developed Market (DM) large caps have become more expensive in valuations, is it time now for small and mid cap laggards to catch up?

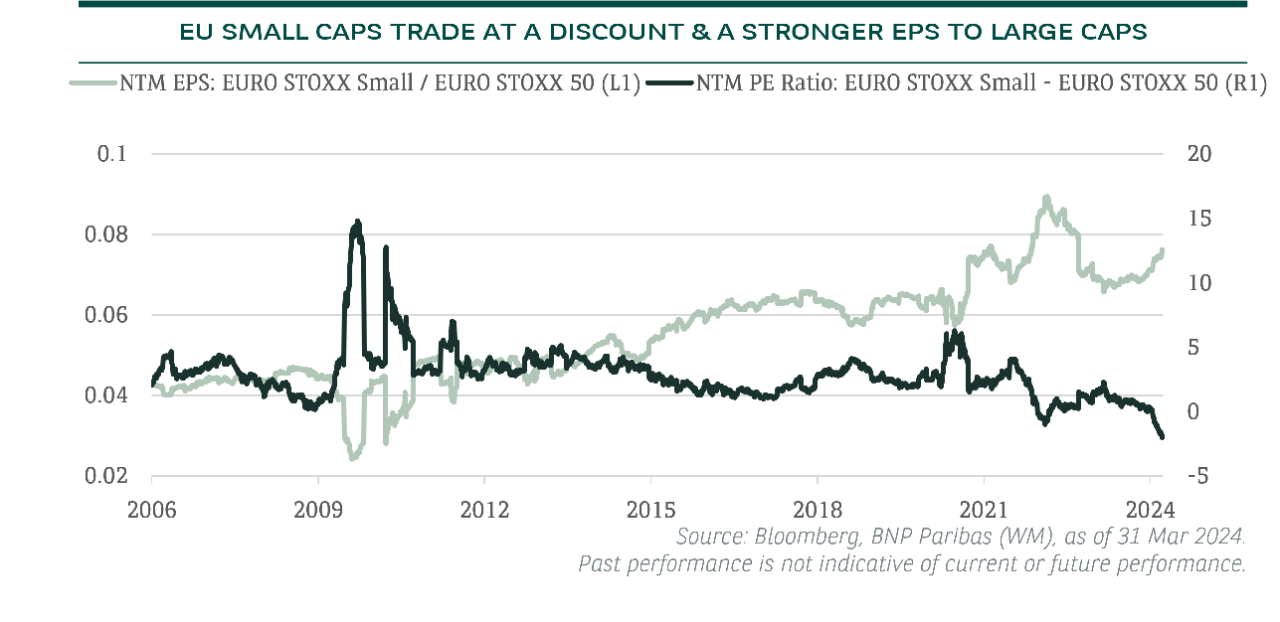

After upgrading US small caps to positive in February 2024, we have upgraded European small caps to positive recently on the back of appealing valuations and an improving economic backdrop.

We also continue to be positive on Japan including small and mid caps despite the Bank of Japan raising interest rates.

US: Rate cut expectations & resilient growth

We further revised up our 2024 US GDP growth forecast to 2.8% from 2.0% previously, above Bloomberg consensus of 2.2%. Our 2024 US CPI forecast also revised up to 3.1% from 2.7%, slightly higher than the Bloomberg consensus of 2.9%.

Despite stronger growth and slightly higher inflation expectations, we still expect rate cuts this year, though less cuts than our original forecasts. We expect the Fed to have three rate cuts this year, starting from June (vs four cuts previously).

There are more signs of economic rebound in the US, with the US ISM Manufacturing PMI returning to expansion in March 2024 after 18 months. US consumer confidence and housing market are also turning around despite still high mortgage rates as housing and construction data surprised to the upside.

In fact, the catch up rally of US small/mid caps has been happening since late 2023 when the Fed hinted at the rate cut potential this year. We still see room for further upside as US small/mid caps are still trading at an 8% discount to the US large caps, while EPS growth for US small caps (+16%) is higher than US large caps (+11%).

Europe: Economy is turning around

Eurozone economy seems to have already passed the trough, as credit conditions continue to improve and housing market is bottoming out. Consumer, business and construction confidence are also rebounding. The Eurozone’s final composite PMI rose 0.4 points from the preliminary release to 50.3 in March, the first reading above 50.0 for 10 months. Eurozone’s Economic Surprise Index is also close to its 11-month high.

With easing inflation in the region, we maintain our view for the ECB to have three rate cuts this year, also starting from June 2024, and another three cuts next year.

Europe’s market breadth recently hit its narrowest point since 2000 as less than 45% of the Euro Stoxx 600 managed to beat the index YTD. Historically, such occasions resolved by the rest of the index catching up instead of the leaders dragging the index down. In fact, 4 out of 6 prior troughs in breadth, saw small caps leading the market higher over the next 6 months.

This also comes at a time where European small caps are trading at a deeper forward PE discount (13%) than 2008 Global Financial Crisis (7%) relative to their large cap peers, while at the same time European small caps are showing the higher EPS growth (+18%) versus large caps (+5%).

Japan: Higher nominal GDP & earnings

The structural trends of economic reflation and corporate governance reform are still on track. Although rising rates tend to be perceived as headwinds for equities, we see Japan’s exit from negative interest rates a tailwind.

Previous distortions from negative rates, such as, increased pension fund and insurance company deficits, and lower bank profitability, and subdued credit creation, etc. are abating.

The normalisation of monetary policy is a very slow process. Japan’s financial conditions remain accommodative as the BOJ maintains its current JGB purchase amounts. We expect the next small hike to happen in September 2024.

It indicates the economy has decisively exited deflation, supporting higher nominal GDP growth and, in turn, higher nominal earnings, which are expected to be seen in small and mid caps as well.

M&A activity is set to rebound

Easing financial conditions, rate cut expectations and turnaround in DM economic growth would see a material uptick in the M&A activity this year, which is traditionally supportive for small caps.

Almost USD 9 trillion pile of cash in money funds is currently sitting on the sidelines. Global private equity firms are also facing pressure to deploy capital raised in previous years as dry powder is estimated to hit a record USD 2.6 trillion.

Key risks

CONCLUSION

The small/mid cap asset class currently provides a great opportunity for portfolio diversification at a compelling price.

With the Fed and ECB’s rate cut cycle around the corner, we see potential for DM small/mid caps to bounce back strongly out of downturns as they are often more economically sensitive than their large cap counterparts.